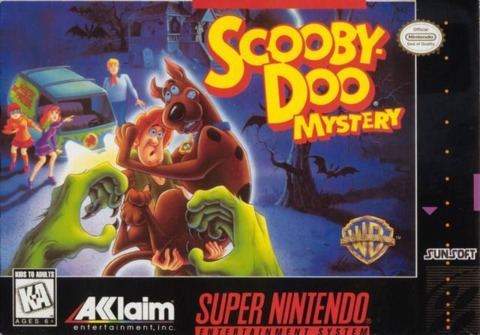

Scooby-Doo Mystery Cheats For Super Nintendo Get all the inside info, cheats, hacks, codes, walkthroughs for Scooby-Doo Mystery on GameSpot. SNES Super Nintendo SCOOBY DOO...

Good link - Online Funny Games

Read More

Good link - Online Funny Games

Read More

Scooby-Doo Mystery Cheats For Super Nintendo

Scooby-Doo Mystery Cheats For Super Nintendo  Huge Prime Day Discounts For The Matrix Trilogy And Other 4K UHD Movie Collections

Huge Prime Day Discounts For The Matrix Trilogy And Other 4K UHD Movie Collections  Call Of Duty Godzilla Cosmetic DLC Released Early, Looks Amazing

Call Of Duty Godzilla Cosmetic DLC Released Early, Looks Amazing  Cyberpunk 2077 Issues Hurt CD Projekt’s Profit

Cyberpunk 2077 Issues Hurt CD Projekt’s Profit  Batman’s Arkham Origins XE Suit Gets A $375 Hot Toys Figure

Batman’s Arkham Origins XE Suit Gets A $375 Hot Toys Figure